Pay Insurance Premiums with Muang Thai Smile Credit Card and Receive 0.25% Cash Back

Muang Thai Smile Credit Card is the insurance card for modern-minded customers to receive privileges from Kasikornbank and Muang Thai Life Assurance PCL. The card provides two tiers: Pink Card and Pink Gold Card.

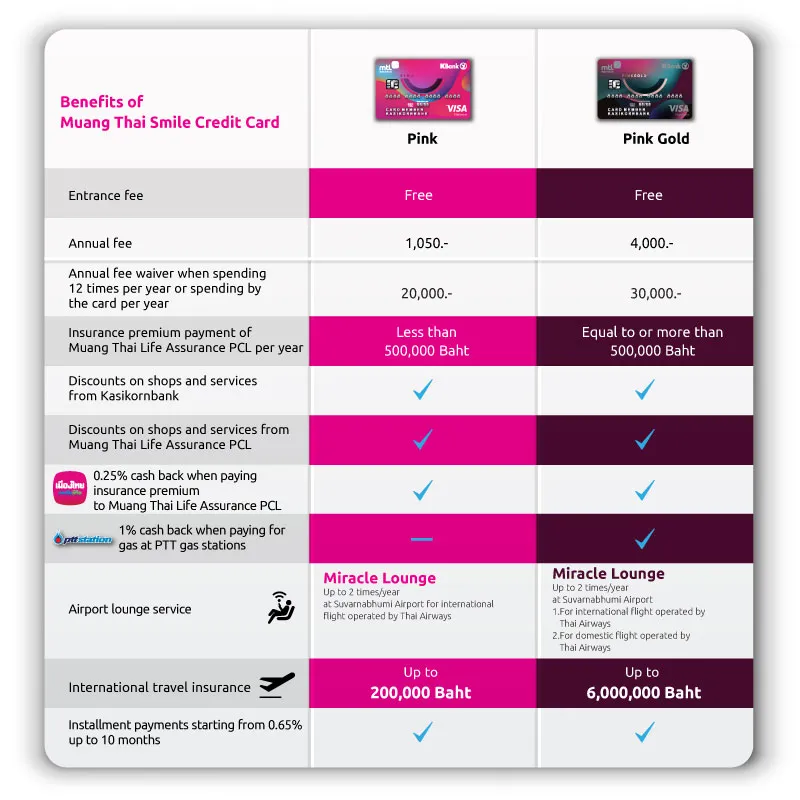

Muang Thai Smile Credit Card Benefits

1. Receive 0.25% cash back of the insurance premium paid to Muang Thai Life Assurance PCL. The cash back amount is unlimited.

2. Receive 1% cash back when paying for gas at PTT gas stations nationwide of at least 800 Baht/sales slip (only for Pink Gold card).

3. Free! Relax before an international flight with Thai Airways at Miracle Lounge at Suvarnabhumi Airport.

4. Free! Relax before a domestic flight with Thai Smile Airways at Miracle Lounge at Suvarnabhumi Airport (only for Pink Gold card).

5. Travel with confidence with international travel insurance providing maximum coverage amount of 6 million Baht.

6. Earn points 2 times, KBank Reward Points and Smile Points, when paying for insurance premiums to Muang Thai Life Assurance PCL.

7. Receive 1 KBank Reward Point for every 25 Baht spent. Choose to redeem the privileges from Kasikornbank of your choice.

8. Installments start at 0.65% for up to 10 months via KBank Smart PAY and K PLUS Application.

9. Discounts on shops and services from Kasikornbank See details

10. NEW!!! Discounts on shops and services from Muang Thai Life Assurance PCL. See details

*Other conditions are as specified by the Bank and/or the Company.

Underwriting is subject to the Company’s rules. Benefits, coverage and exclusions are as specified in the policy.

Cash back

- Receiving 0.25% cash back with unlimited amount when paying insurance premium to Muang Thai Life Assurance PCL

Conditions

1. Must be insurance premium payment of Muang Thai Life Assurance PCL by Muang Thai Smile Credit Card only

2. No minimum premium payment amount for receiving the cash back

3. Single premium, short-term premium, term life insurance and all personal accident insurance plans (except PA Return Bonus) are not eligible for the cash back.

4. All types of insurance premium installments, repayment of policy loan and interest, repayment of automatic premium loan (APL) and interest and insurance premium payment by accumulated credit card points are not eligible for the cash back.

Cash back payment

1. Unlimited cash back amount

2. The Bank shall credit the cash back into the co-branded credit card account within 3 (three) billing cycles from the monthly statement date and after the complete payment in accordance with the specified conditions. For example, if the balance summary date is 17th of every month, a customer pays insurance premiums on 15th July. 17th July is the 1st billing cycle, 17th August is the 2nd billing cycle and 17th September is the 3rd billing cycle. Hence, the customer will receive cash back by 17th September.

3. The calculated cash back from the co-branded credit card will be displayed and used to reduce expenses paid by the co-branded credit card according to the credit card statement in the month when the cash back is credited.

4. Cash back credited to a co-branded credit card account cannot be converted into cash or transferred to others.

5. In case there is a refund of insurance premiums due to payment cancellation or refusal from using the co-branded credit card in all cases, the customer will not be entitled to the cash back. If such case occurs after the Bank has already refunded to the co-branded credit card account and used to reduce expenses, the Bank will take back the cash back from the co-branded credit card account.

6. The right is reserved for co-branded credit card holders with spending according to the conditions and the holders who are still a co-branded credit card member with payment record of co-branded credit card that meets the conditions specified by the Bank.

- Receiving 1% cash back when paying for gas at PTT gas stations

Conditions

1. Benefits for paying for gas at PTT gas stations nationwide

2. Receive 1% cash back (limited to160 Baht per card per month) when paying for gas at PTT gas stations from at least 800 Baht/sales slip.

Cash back payment

1. The Bank shall credit the cash back into the co-branded credit card account within 3 (three) billing cycles from the monthly statement date and after the complete payment in accordance with the specified conditions.

2. The calculated cash back from the co-branded credit card will be displayed and used to reduce expenses paid by the co-branded credit card according to the credit card statement in the month when the cash back is credited.

3. Cash back credited to a co-branded credit card account cannot be converted into cash or transferred to others.

4. The right is reserved for co-branded credit card holders with spending according to the conditions and the holders who are still a co-branded credit card member with payment record of co-branded credit card that meets the conditions specified by the Bank.

Comparison of Pink Card and Pink Gold Card

How to Apply

1. Download Muang Thai Smile Credit Card application form Click Download

2. Download the application form filling guide Click Download

3. Contact any Kasikornbank branch nationwide to verify your identity along with submitting supporting documents for the application: ID card and income statement.

For more information, please call K-Contact center Tel. 02-888-8888

Application documents

Thai applicants

1. Be the owner of at least one life insurance policy with Muang Thai Life Assurance PCL. that is still active.

2. ID card

3. Income statement

4. Muang Thai Smile Credit Card application form

Non-Thai applicants

1. Be the owner of at least one life insurance policy with Muang Thai Life Assurance PCL. that is still active.

2. Passport

3. Visa or work permit in Thailand

4. Income statement

5. Muang Thai Smile Credit Card application form