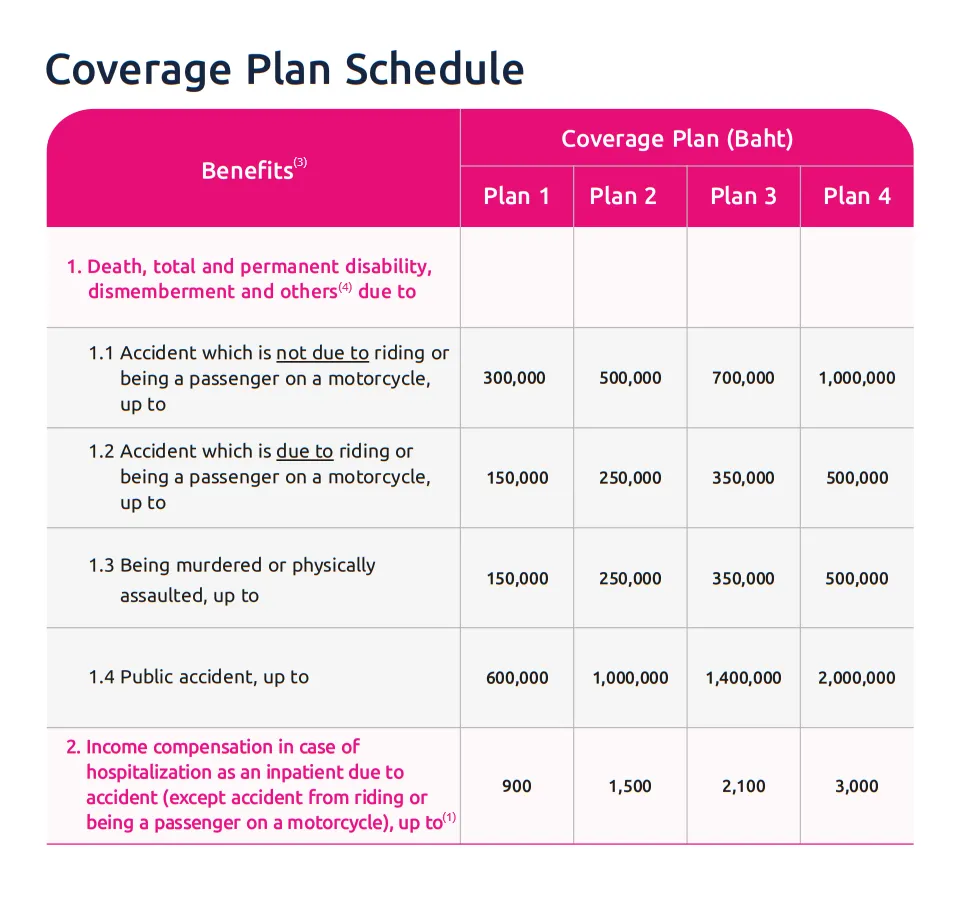

(1) In case of medical necessity that the insured must be admitted in the intensive care unit (ICU), the Company will pay twice the income compensation during hospitalization. However, it must not exceed 7 days and the total income compensation during the hospitalization must not exceed 365 days per injury.

(2) For coverage plan 4.

(3) Coverage area: 24/7 worldwide coverage for 1 year

(4) Benefits of dismemberment and others including loss of eyesight, hearing and speech are according to the percentage specified in the insurance policy.

• This premium is basic information which is subject to change based on different factors such as increasing age, individual occupation class, the Company's claim experience, etc. The premium must be approved by the registrar. Conditions are specified in the insurance policy.

• Premium is partially eligible for tax deduction according to the Revenue Department.

• Underwriting is subject to the Company's rules.

Q: Who is PA Take Care suitable for?

A: Breadwinners which this insurance can be security for loved ones; or those who already have accident coverage welfare, but need compensation in case of hospitalization due to accident as to still receive income regardless of taking leaves.

Q: Does PA Take Care cover accidents from being motorcycle rider or passenger?

A: It covers in case of death, loss of organs, eyesight, hearing, speech, and permanent disability from being motorcycle rider or passenger only. For benefit of compensation during inpatient hospitalization due to accident, it shall not be provided for accidents from being motorcycle rider or passenger.

Q: Do occupational classes affect underwriting of PA Take Care?

A: Occupational classes have an impact on underwriting of PA Take Care. The Company shall provide coverage only for those in occupational classes 1, 2 and 3 only. Details are as follows.

- Occupational Class 1 includes business owners, those working in services or management, office workers, or salespersons in businesses or trades, most of which are stationed in offices as well as work of craftsmanship with no involvement in machinery; the nature of work contains low accident risks.

- Occupational Class 2 includes business owners, those working in services or management, office workers in businesses or trades requiring occasional offsite work, or those working in the industrial field, most of which require expertise in whole or in part and sometimes involve in the use of machinery or require the workers to work outdoor almost all the time; the nature of work contains moderate accident risks.

- Occupationl Class 3 includes those working in mechanics or production process or services, most of which requires heavy machinery, or those who are logistics labors and workers requiring regular travel or offsite work; the nature of work contains high accident risks.

In this regard, the Company will not consider providing insurance for individuals engaged in high-risk occupations, such as high-rise window cleaners, professional boxers, wrestlers, motorcycle taxi drivers, ten-wheeler truck drivers, firefighters, stunt performers, substitute actors (stand-ins), jockeys, horse trainers, horse grooms, animal trainers, diver, forest workers (in the forest), police, and military personnel (in field service), etc.

Q: Is health checkup required?

A: No, it is not. However, the applicants are required to declare their actual health information to the Company. Underwriting is subject to the Company’s rules.

Q: Can I purchase other riders after having this personal accident insurance?

A: No, you cannot purchase other riders to attach to the insurance policy.

Q: Is this personal accident insurance eligible for tax deduction?

A: Yes, it is partially eligible for tax deduction according to the Notification of the Director-General of the Revenue Department on Income Tax No. 383.

Q: What plan of personal accident insurance should I buy? Or where should I buy?

A: There are many accident insurance products; PA Take Care from Muang Thai Life Assurance is one of them that provides compensation during inpatient hospitalization due to accident, and 2 times benefit in case of death from public accidents such as accidents that occur in skytrains, subways, elevators, shopping malls, movie theaters, etc.

Exclusions of PA Take Care from a total of 20 clauses

For example, it shall not cover any loss or damages due to or a result of either of the following causes:

1. Acts of the insured while under the influence of alcohol, narcotic drugs or narcotic substances that impairs the insured’s mental faculty. The term “under the influence of alcohol” is in case of having blood alcohol concentration (BAC) test result of 150 mg/dL or over.

2. Suicide, suicide attempt or self-inflicted injury

3. Back pain as a result of Disc herniation, Spondylolisthesis, Degenerative disc disease, Spondylosis and defect, or Spondylolysis unless there is fracture or dislocation of the spine caused by accident

4. War, invasion, act of foreign enemies, or warlike actions whether declared or undeclared, or civil war, insurrection, rebellion, riot, strike, civil commotion, revolution, coup d’etat, proclamation of martial law or any incident causing the proclamation or maintenance of martial law

5. Terrorism, etc.

Buyers should have an understanding in the details of coverage and conditions before making a decision to purchase insurance every time.

Disclaimer: This English translation is intended for reference only. The Thai version shall be the only legally binding version. In the event of discrepancy between the Thai version and the English translation, the Thai version shall always prevail.